These are the core obsessions that drive our newsroom—defining topics of seismic importance to the global economy.

These are some of our most ambitious editorial projects. Enjoy! Our emails are made to shine in your inbox, with something fresh every morning, afternoon, and weekend.

In the second year of the covid-19 pandemic when everything seems a little strange, analyzing the way companies talk about their products, economic trends, the pandemic, and the future of technology can shed light onto their priorities and struggles. The stock market can’t be tamed, US inflation is higher than most Americans can remember, businesses are short-staffed, parts are scarce, crypto is booming, and remote work is normal for many.

Quartz analyzed public business documents, including conference-call transcripts and financial statements, for the latest and greatest buzzwords of the year. They range from economic factors like the global supply chain crisis and the semiconductor shortage to the cutting-edge in finance and technology: the metaverse, NFTs, and meme stocks.

The term “supply chain” has gone from jargon to meme. Covid-era disruptions and increased consumer demand has brought the wonky term into the limelight. If you weren’t talking about bottlenecks and air freight before the pandemic, you almost certainly Googled some of this terminology while panic-ordering holiday gifts and praying for on-time delivery.

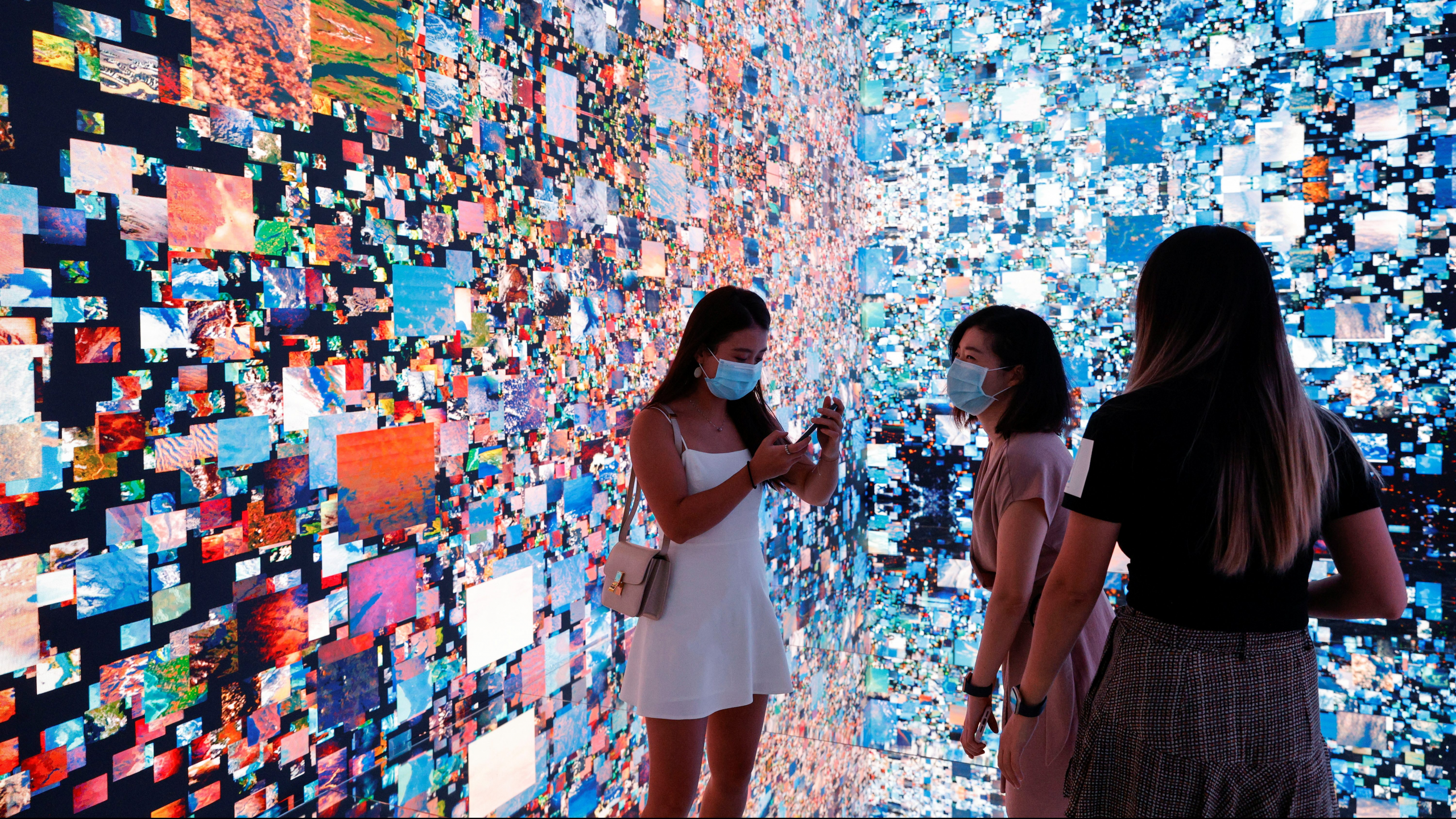

In March, the digital artist Beeple sold a collage of his work at Christie’s for a whopping $69 million. The sale made Beeple rich, kickstarted a cozy relationship between auction houses and crypto, and forced the world to collectively ask, “What the hell is an NFT?”

Basically, it’s is a blockchain-encrypted certificate of authenticity. Its uses are more varied than just the blue-chip art market: NFTs are instrumental to certain games, fundraising efforts, and collector communities. Quartz even sold the first NFT of a news article for $1,800 and donated the proceeds to charity.

The term “metaverse” was coined by the science fiction writer Neal Stephenson in his 1992 novel Snow Crash, to describe a persistent virtual-reality world navigated by the book’s protagonist. Stephenson’s writing has long inspired the tech industry, including the online world Second Life, which launched in 2003. But in 2021, it went mainstream. Now, Microsoft, NVIDIA, Intel, Unity, Epic Games, and Roblox are all talking about the metaverse. Facebook even renamed itself Meta. So what is the metaverse? It doesn’t exist yet, so it’s hard to tell. But imagine that instead of scrolling, clicking, and writing on the internet, you walk through it, you see it, you feel it, and you’re immersed in it. Techno-utopia or dystopia? That’s for you to decide.

US inflation is at its highest level in 30 years, likely a reaction to months of pandemic lockdown and a symptom of the global supply chain crisis. The US Federal Reserve has been mulling ways to slow price increases, but the Fed’s main tool, raising interest rates, won’t help if the supply chain crisis isn’t fixed. Not only is every company thinking about inflation right now, every shopper is too.

McDonalds, IKEA, Microsoft, and even Big Oil firms like Shell and BP sent representatives to COP26 the climate conference in Scotland, this year. Whether this amounts to real action on corporate ESG (environment, social, governance), or mere greenwashing, isn’t clear. But at least companies are finally talking about climate.

Executives are talking a lot about a labor shortage. But as Quartz reported, US companies are actually facing a “wage shortage” as the pay needed to hire employees is increasing and employers can’t keep up.

Every big social platform thinks of their users, to an extent, as creators. And they all either pay creators directly or give them tools to make money off their audience. The popularity of creator platforms like OnlyFans, Substack, and Cameo has added to the ways real-life and internet-famous individuals can build, make content for, and communicate with their audience.

In January, reddit users—enabled by a boom in online retail investing and no-fee trading—pushed GameStop stock from $17 to $483 a share in a matter of days. But GameStop wasn’t an isolated incident: online investors rallied around AMC Entertainment, Blackberry, Bed Bath & Beyond, and more. The name for these investments? Meme stocks. Nearly a year later, meme stocks have become a known unknown for Wall Street.

The pandemic sent the semiconductor industry scrambling because just about everything—cars, household appliances, the latest video game console—has a chip in it. The shortage isn’t something chip manufacturers can fix overnight. Making chips is a very expensive and lengthy process. What’s happening is akin to the bullwhip effect: a small movement of the hand sends the whip rippling larger and larger in the air. Wondering why car prices are so high or you can’t find a PlayStation 5? Blame the chip shortage.

SPACs, also known as blank-check companies, are public companies that exist to take private companies public by merging with them. They’re an alternative to the initial public offering (IPO) and can be quicker and easier. The deals don’t require underwriting from an investment bank. SPACs have existed in their current form since 2003, but boomed during the pandemic. In 2020, SPAC deals more than tripled compared to the year before from 26 to 93 per year. Now deal totals doubled again, rising to 181 in 2021.

In the last two years, US SPAC deals had a total value of $500 billion, according to Refinitiv. Companies like Nikola, DraftKings, Purple, and Virgin Galactic all SPACed. But whenever there are SPACs there are warnings that the SPAC bubble will surely burst.