tolgart/E+ via Getty Images

I’ve long been interested in ETFs that offer investors exposure to market trends by tracking the major players that operate within those markets. I wrote at length about VanEck’s ETF, BUZZ (NYSE:BUZZ), that tracks the internet’s most hyped stocks. Recently, another ETF has caught my attention – Roundhill Ball Metaverse ETF (NYSEARCA: META).

According to Roundhill Investments,

The “Metaverse” is defined as a successor to the current internet that will be interoperable, persistent, synchronous, open to unlimited participants with a fully functioning economy, and an experience that spans the virtual and ‘real’ world.

The current internet that I’m using to publish this article and you’re using to read this article, whether that be on your phone or desktop, evolved from the hardline internet of the 1990s. The Metaverse stands to be the next phase of this evolution.

Roundhill’s main thesis in creating this ETF is their position that the Metaverse will become the successor of the current internet. They’re banking on the Metaverse building an experience that spans throughout both the virtual and real world – with real-world financial impacts.

While the Metaverse is largely unchartered waters at this stage, many companies are developing or interacting with this virtual world already – Facebook being the most obvious. For example, Nvidia (NVDA) and Cloudflare (NET) are developing critical infrastructure essential to the Metaverse. Roblox (RBLX) and Unity (U) are the gaming engines that have been creating virtual worlds as their service. Tencent (OTCPK:TCEHY), Sea (SE), and Snap (SNAP) have begun expanding the commerce and social arms of the virtual world.

While many companies have entered the space, not all are included within the holdings of this ETF. Roundhill utilizes a proprietary index to identify who shall be included.

The Ball Metaverse Index is the first index globally designed to track the performance of the Metaverse. The Index consists of a tiered weight portfolio of globally-listed companies who are actively involved in the Metaverse. This classification includes:

Compute: companies enabling and supply of computing power to support the Metaverse.

Networking: companies providing real-time connections, high bandwidth, and data services to consumers.

Virtual Platforms: companies developing and operating immersive digital and often three-dimensional simulations, environments and worlds wherein users and businesses can explore, create, socialize and participate in a wide variety of experiences.

Interchange Standards: companies building tools, protocols, formats, services, and engines which serve as actual or de facto standards for interoperability, and enable the creation, operation and ongoing improvements to the Metaverse.

Payments: The support of digital payment processes and operations, which includes fiat on-ramps to pure-play digital currencies and financial services.

Content, Assets, and Identity Services: The design/creation, sale, resale, storage, secure protection and financial management of digital assets, such as virtual goods and currencies, as connected to user data and identity.

Hardware: The sale and support of physical technologies and devices used to access, interact with or develop the Metaverse.

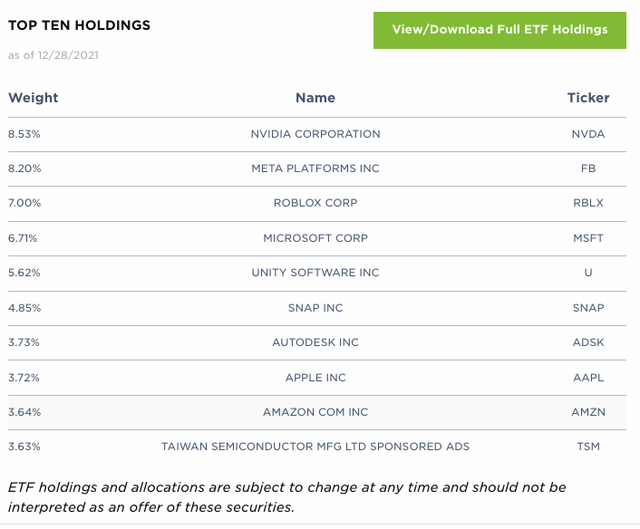

As long as a business can fit the criterium listed above, they’ll earn a spot in the index. The top 10 holdings are as follows:

Source: Roundhill Investments

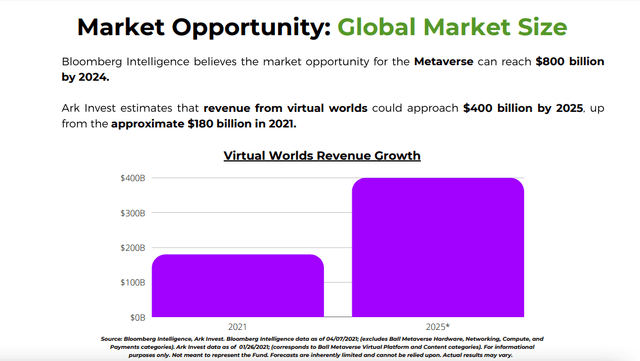

Source: Roundhill Investments

As evident from the chart above, major players such as Bloomberg Intelligence and ARK Investors are projecting massive revenue targets for the Metaverse in the near term.

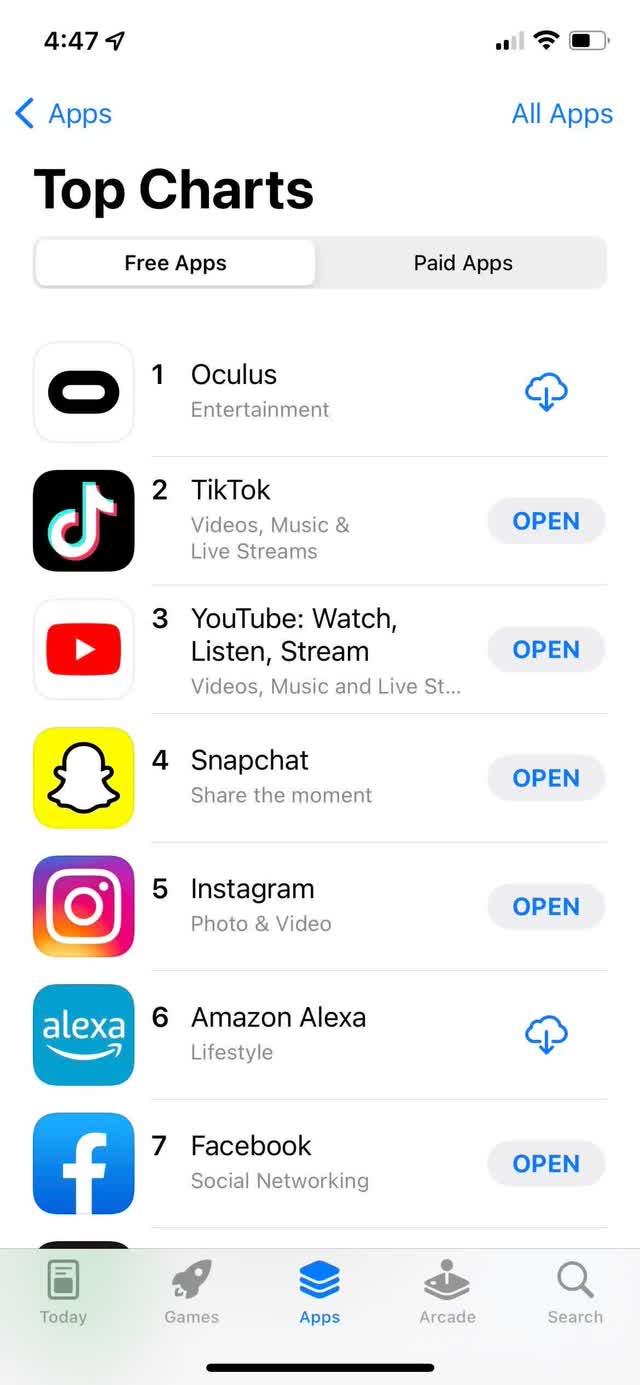

We’re already seeing the entry point of the Metaverse to our daily lives in a variety of ways. Cryptocurrency goes without saying with the rise of bitcoin and alternative currencies this past year. As a whole, cryptocurrency was undoubtedly one of the hottest topics of conversation at most holiday dinners this year. Similarly, Oculus VR was the #1 application downloaded on Christmas Day.

Source: CNBC Business

This is the app that owners of the Oculus VR headset rely on to manage their headset and the virtual world within. Meta, the parent company of Facebook, has announced that this year the company will invest at least $10 billion to build the metaverse. Zuckerberg believes that this world will become the new normal for social networking, gaming, and potentially the workforce in the future.

Zuckerberg and Co. are so bought into this new reality that he changed the name of Facebook to Meta last fall. Unfortunately, Zuck didn’t get the META stock market ticker, as Roundhill had already locked that up above 5 months prior.

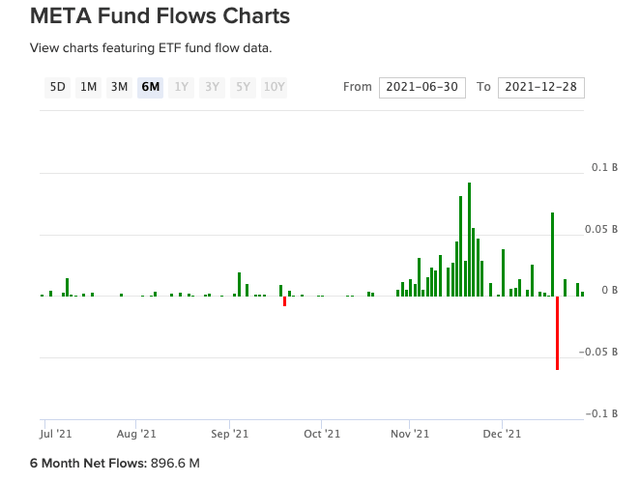

Roundhill, and their Metaverse ETF, were one of the largest benefactors of the Facebook pivot. This move brought the Metaverse to the forefront of the national (and international) zeitgeist. As a result, investors and their capital starter pouring in. Currently, the ETF has $896,000,000 assets under management.

Source: ETF Database

As the Metaverse expands into other facets of our daily lives aside from risk assets and entertainment, we will see more businesses attracted to the space due to fear of missing out. Nike (NKE) even took a plunge into the Metaverse with a virtual world of their own, Nikeland.

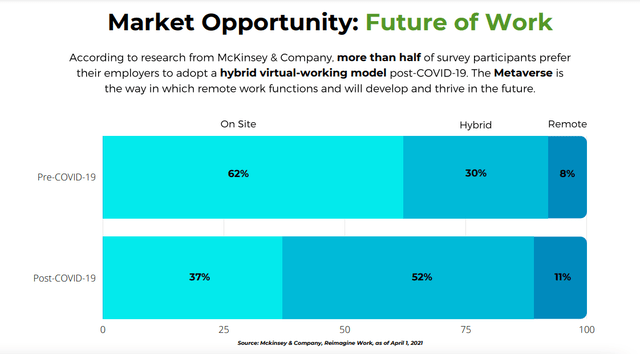

On a more pragmatic level, the Metaverse has a very real chance of interloping with the recent pivot to remote “work-from-home” life. Rather than hopping in your car and commuting to work for an hour, proponents of virtual reality offer the alternative of simply throwing on your VR headset, logging into the metaverse, creating your avatar, and working remotely while still collaborating with others.

Source: Roundhill Investments

If workers prefer the remote alternative to actually going into a physical office, I don’t see how the metaverse gets left out of the picture. Especially with major players in Silicon Valley buying into this, I expect this to become commonplace very soon. There are so many industries that offer compelling entry points to this kind of technology. At one point, VR was viewed as a form of entertainment. Now, it should be taken much more seriously.

The Metaverse has a chance to generate an economy that spreads from the workforce to entertainment. Long-standing industries such as finance, banking, and software could feasibly be accomplished through a Metaverse-approach to work. Dating, gaming, education, retail, and fitness will be the next dominos to follow.

Similar to the cryptocurrency “experts” you might come across on Twitter or Reddit, anyone that claims to be an expert on the Metaverse is the opposite. That’s not to say that they don’t have any idea what they’re talking about, but rather that Web3 is completely new. These are unchartered waters being ushered along by factors that aren’t yet measurable. The metaverse doesn’t release a 10K for us to analyze. There is no tangible way to assess its performance on a financial level or fully project where this is headed. We are expanding into a completely new frontier.

As Laura Forman of the Wall Street Journal writes,

Unlike fully baked industries, which boast years of user and sales metrics, even the most informed bet on the metaverse right now would be something of a leap of faith. Perhaps real estate is a good analogy: The best investments are often in the neighborhood you believe will become something in 10 years, not the neighborhood that is already something today.

After publication, I plan to set some money aside to invest into the META ETF at the $15 per share price point. I’m still fairly hesitant on just how soon the metaverse will be adopted by society for business, leisure, and entertainment. The current price of this ETF is what seems like the best opportunity to me.

Source: Seeking Alpha

As you can see from the chart above, investors have a chance to buy META at the price before the stock jumped from the Facebook – Meta name change back in October.

If the metaverse is being accepted as the next phase of the internet’s evolution to Web3, it’s only a matter of time before every tech company jumps in headfirst. It helps that Zuckerberg is a key stakeholder of this new frontier and has already put substantial skin in the game. Fully expecting more companies to dive into this endeavor in 2022, but also understanding just how early this is, I’m comfortable buying in now and waiting for this position out for the long term.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in META over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.